The Main Street Journal

ABOUT

Launch – June 16th, 2023

The MAIN STREET JOURNAL was launched online in 2023, as a kind of Canadian, small business counterpoint to the venerable WALL STREET JOURNAL (WSJ), established in New York City in 1889.

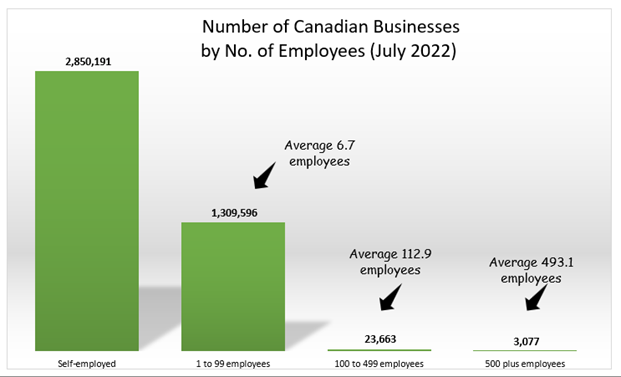

Canada’s small businesses are smaller than most people think.

This is true for people that work in small businesses, for policymakers, business schools, and the business press. The self-employed and other small business owners don’t ‘get no respect’ and yet about 73% of private sector employment in Canada is made up of the 2.85 million self-employed individuals, and 1.3 million small employer businesses which average less than 7 employees.

We believe it’s time that these workers, and the small business owner-managers that employ them, got some respect. What’s more, we believe that business schools and policymakers should get out of their ivory towers and take a walk on Main Street!

The Editorial Board

FINANCE for CANADA’S SMALL BUSINESSES

FINANCE for CANADA’S SMALL BUSINESSES Canadian Tech Playbook

Here’s an enhanced, more polished version of your blog post—tightened for clarity, stronger flow, and a more provocative close, while...

FINANCE for CANADA’S SMALL BUSINESSES

FINANCE for CANADA’S SMALL BUSINESSES VC-Backed FAAS

As a professional accountant with more than 3 decades of experience - including 5 years with the CRA as an...

SMALL BUSINESS ACCOUNTING + SYSTEMS DESIGN

SMALL BUSINESS ACCOUNTING + SYSTEMS DESIGN CPA Canada Moat protects Largest Firms

Given that CPA Canada has made it easier for accountants in industry to qualify as CPAs, and disrupted the nature...

SMALL BUSINESS ACCOUNTING + SYSTEMS DESIGN

SMALL BUSINESS ACCOUNTING + SYSTEMS DESIGN CSRS Compilation vs Notice To Reader

Given that CPA Canada has made it easier for accountants in industry to qualify as CPAs, and disrupted the nature...

SMALL BUSINESS ACCOUNTING + SYSTEMS DESIGN

SMALL BUSINESS ACCOUNTING + SYSTEMS DESIGN FAAS Bypass

Is FAAS (Finance As A Service) Just a Way to Bypass Regulatory Oversight? CPA Canada's new competency map for public...

FINANCE for CANADA’S SMALL BUSINESSES

FINANCE for CANADA’S SMALL BUSINESSES CPA Competency Map Issues

Canada's new competency map for CPAs: Makes it difficult (or impossible) for small, one or two-partner firms to train their...