This company was featured in a recent article in the GLOBE AND MAIL – Canada’s National Business Newspaper

The headline was:

Canadian companies face unexpected tax burdens after going public on stock exchanges

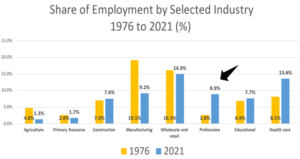

“Canada has been the worst-performing advanced economy in the Organization for Economic Co-operation and Development since 1976. Governments of all partisan stripes have tried and failed to reverse the trend. If nothing changes, the OECD projects, our economic growth per capita will continue to stagnate for decades to come. This article is part of an occasional series called Per Capita, which examines how and why policy interventions have come up short – and how fresh approaches to economic growth are urgently needed.

When Andrew White took his company public on the TSX Venture Exchange in 2016, he was more focused on what he stood to gain than what he stood to lose.

[1] JAMESON BERKOW CAPITAL MARKETS REPORTER PUBLISHED MAY 2, 2023

But once CHAR Technologies Ltd. YES-X was no longer a private corporation, he discovered that major tax benefits – incentives for scientific research and experimental development (SR&ED) being key among them – were no longer available to his business.

That’s because Canada’s tax rules provide Canadian-controlled private corporations (CCPCs) with access to incentives that are not available to public companies – a policy that capital markets experts say creates artificial barriers to growth.”

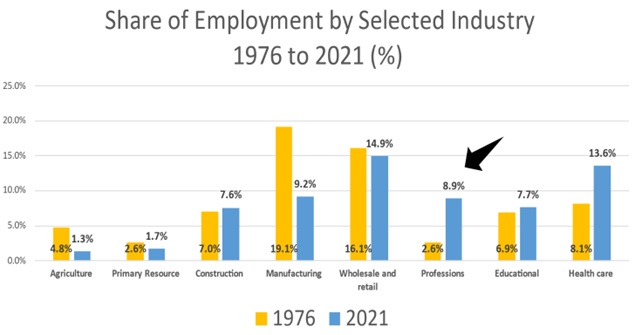

Certainly, we don’t argue with the fact that Canada’s productivity has lagged that of many of our counterparts in the developed economies. This is true despite having among the highest levels of post-secondary education in the world. (More about that in a future post.)

But it’s ludicrous to blame that on Canada’s tax rules for public companies.

Of course, that didn’t stop the article from laying out this claim:

“The reason he can’t, according to TMX Group CEO John McKenzie, is because Canadian policymakers harbour an inaccurate view of the country’s public companies.

It is a lack of knowledge and understanding and a bias around public companies being big companies,” Mr. McKenzie said in an interview.

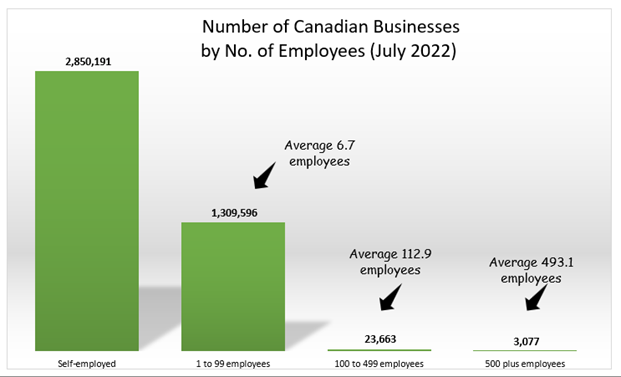

Governments may “want a policy to just help small businesses, so they will make it applicable to Canadian-controlled private corporations without recognizing that two-thirds of our public listings are small and medium-sized enterprises.”

Data from S&P Capital IQ and the TMX Group’s internal sources show that of 2,284 companies listed on the TSX and TSXV, 1,489 have fewer than 250 employees, representing 65 per cent of the total. While the vast majority of those companies – 1,350 – are listed on the TSXV, where issuers are generally smaller, that still leaves 139 companies on the senior TSX exchange with fewer than 250 employees, or 18 per cent of the total.

Statistics Canada considers any company with fewer than 500 employees a medium-sized business and any company with fewer than 100 employees a small business.

The unintended consequence of tax policies that withhold certain benefits to public companies, Mr. McKenzie said, “is that if I’m a private company that gets those credits today, if I want to raise new public money to expand and grow what I’ve built, then I’ve got an extra cost of raising that public money.”

In our view, the better questions are:

Why are there so many small, under-performing companies like CHAR TECHNOLOGIES LTD. listed on Canada’s stock exchanges?

Why didn’t the company’s professional advisors make the tax implications of going public clear?

There are more than 5 times as many public company listings in Canada on a per capita basis, as there are in the US.

So, we asked CHAT GPT: What is behind this proliferation of small public companies in Canada?

Is it easier for a company to go public in Canada than in other developed countries?

ChatGPT

“It is generally considered easier for a company to go public in Canada than in other developed countries like the United States. There are several reasons for this:

| 1. Less stringent regulatory requirements: Canadian securities regulations are generally considered to be less stringent than those in the US, particularly in terms of disclosure and reporting requirements. This makes it easier and less costly for companies to comply with regulatory requirements when going public. |

| 2. Supportive government policies: The Canadian government has implemented several policies to support small and medium-sized enterprises (SMEs), including tax credits and investment incentives. These policies have made it easier for Canadian companies to raise capital and go public. |

| 3. Strong venture capital ecosystem: Canada has a strong and supportive venture capital ecosystem, which has helped to nurture a vibrant startup culture. This has created a pipeline of innovative companies that are well-suited to the public markets. |

| 4. Access to global capital markets: Canada is located in close proximity to the US and has strong economic ties to Europe and Asia. This makes it easier for Canadian companies to access global capital markets and raise capital from a wide range of investors. |

| While it is generally easier for a company to go public in Canada than in other developed countries, there are still significant costs and challenges associated with the process. These include compliance with securities regulations, high underwriting fees, and the need to navigate complex financial markets. As such, going public is a decision that should be carefully considered and evaluated by any company seeking to raise capital through the public markets.” |

So, we looked up CHAR TECHNOLOGIES LTD. (“CHAR”) on SEDAR……

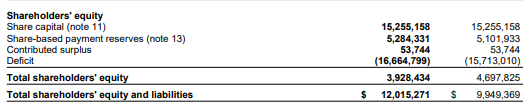

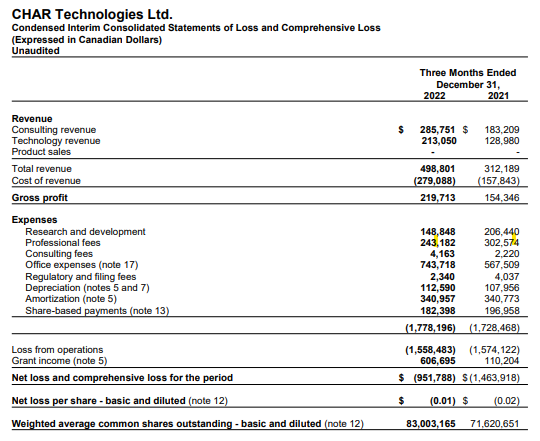

The accumulated deficit since inception is more than $16 million – and exceeds share capital.

The company appears to spend more in professional fees than they earn in gross profit. So why did they go public in the first place?

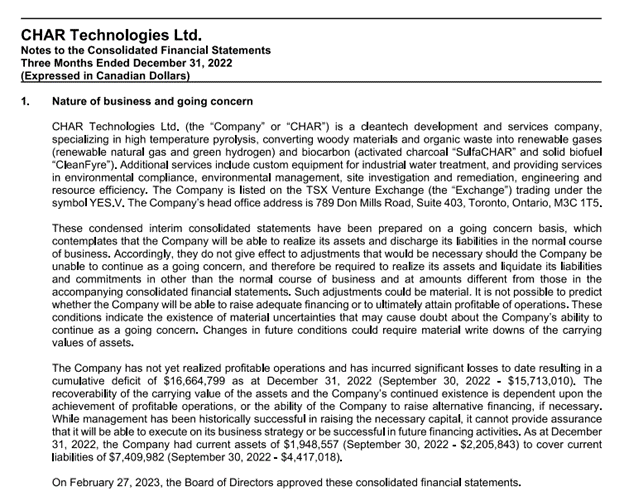

It is important for would-be investors to consider the ‘going concern’ note reproduced below:

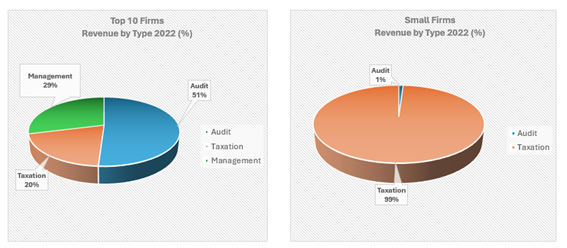

It’s clear to us that this company should never have gone public. If the federal government were to extend refundable tax credits to public companies like CHAR, it is mostly securities lawyers, auditors, and the stock exchange that would probably benefit. That wouldn’t help Canada’s productivity at all.

In our view, the Department of Finance shouldn’t extend refundable tax credits for R&D to public companies. They do allow R&D tax credits to offset taxes on profits. But, allowing public companies with a history of losses to qualify for cash refunds will only benefit the usual hangers-on – like the TMX Group.

In our view, the GLOBE AND MAIL should have done better.