Unicorns don’t exist. So why are there so many of them?

Unicorns are supposed to be mythical beasts. Yet, according to a 2019 article published in the World Economic Forum, there were 326 of them in 2017.

And if the new PM of the United Kingdom has his way, we can expect to see more of them throughout the UK…

Article from IT PRO – May 3, 2023

In 2013 “venture capitalist Aileen Lee coined the term ‘unicorn’ to describe any privately-held start-up worth $1 billion or more.

At the time, such valuations were so rare that they deserved a special name – but since then, it’s fair to say that the landscape has shifted dramatically. The start-up boom intensified, and capital flowed into private companies at an unprecedented pace.”

Of course, it’s not hard to understand why venture capitalists like privately-held companies with billion-dollar valuations. These represent liquidity events for them. That is how venture capitalists get the big bucks. But how valuable have they been for society as a whole?

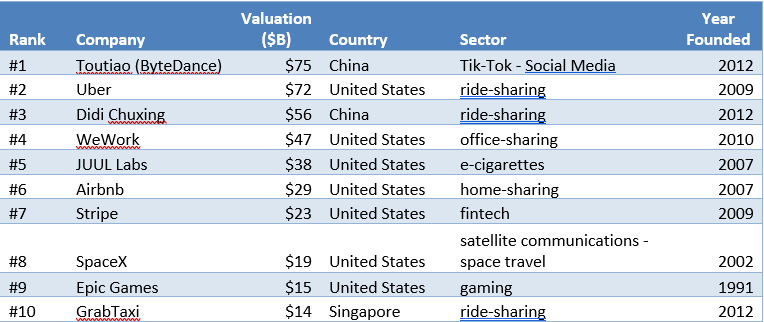

Let us take a deeper dive into what the 10 largest unicorns were, according to that 2019 article.

First, it is clear that China and the US are well-represented in terms of unicorns. They are both economic powerhouses with an abundance of capital.

In terms of what these unicorns do, I would argue that only 2 provide much in the way of value. 3 of them are software enabled networks devoted to ridesharing. Or, as I prefer to call them, taxis for millennials. Then we have ‘office-sharing’ (WeWork). Office sharing is where would-be entrepreneurs gather to participate in start-up culture and share the dream of becoming unicorn riders. And Airbnb helps civilians to operate unregulated hotels.

We’ve now described 5 of the 10 unicorns. We also have e-cigarettes, social media, and another vanity project for Elon Musk.

That leaves us with Stripe which is useful, and Epic Games which provides us with entertainment while we commute, get ready for bed, or have coffee breaks by ourselves. To me at least, that isn’t a ringing endorsement for what venture capitalist Alexandre Lazarow calls “a philosophy, an ethos and a process of building start-ups”.

Yet we devote a great deal of grey matter and ink to the discussion and study of start-up culture. Business schools now offer programs in entrepreneurship, and government incubators – like the US Small Business Administration – offer free advice to would-be entrepreneurs. I recently checked out the advice they offer on business plans. They even offer 2 different models:

The template they offer for the traditional business plan is based on a small, private consulting business. Spoiler alert, you shouldn’t write a business plan for a new consulting business expecting to get conventional financing. You’ll need at least 2 years of profitable operations first. The lean start-up methodology has been championed by Steve Blank at Berkely since it first emerged. In 2013 he began warning would-be founders that “the chances of success for a new start-up are infinitesimally low”.

Since then, the lean start-up methodology has really morphed into a ‘new product launch methodology’ favoured by established businesses entering new markets and launching new products. The point is, the advice offered by the US Small Business Administration is horribly overpriced. And – in case you missed it – it’s free.

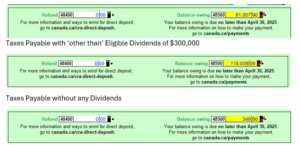

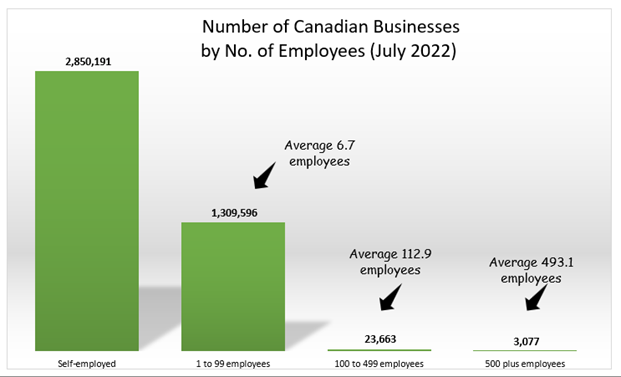

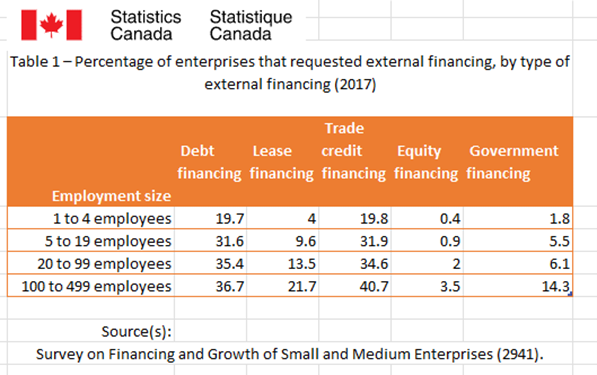

Very few new businesses seek equity financing.

This table, produced by Statistics Canada in early 2019, shows how infrequently businesses of any size seek external equity financing. There is good reason for that. It is expensive to prepare for and pursue equity capital. It also consumes key resources from senior management. In the case of start-ups, management has better things to do.

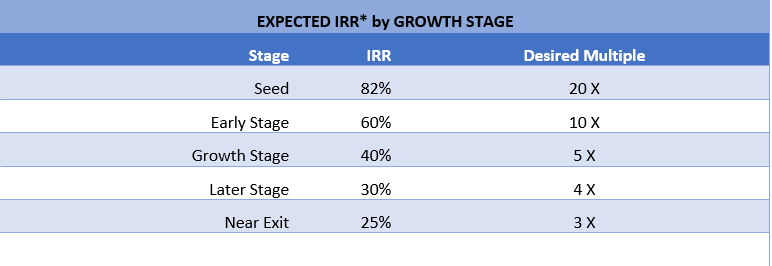

In about 2011 I researched the business models, success rates and investment strategies of Silicon Valley angels.

Angel Resource Institute 2010

* Internal Rate of Return

While the rates of return that angels were looking for were crushingly high, they needed these kinds of returns. Fully 68% of the investments by Tech Coast Angels[1] were written off. So, let’s quantify the risks involved.

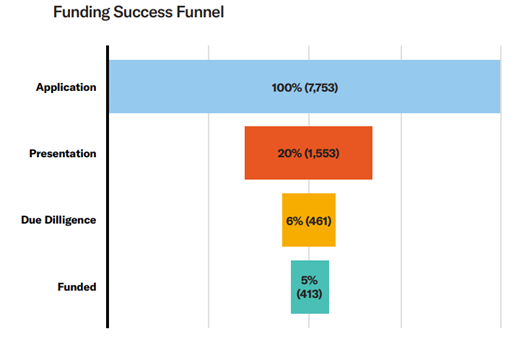

In September of 2022, Canada’s National Angel Capital Organization released their annual report on the state of angel investing in Canada.

[1] the group who were transparent enough to share their results

Of the small number of early-stage Canadian companies looking for equity only 5% (413 companies), received any funding. Of these, we can expect that about 1/3 will result in successful exits. That means that 1.65% of applicants are likely to exit successfully.

We invest heavily in the infrastructure around venture financing. In BC for example, we pay angel investors a 30% cash refund for investments in qualifying small businesses. Certainly, in the early days of my practice I flirted with some local angel groups. I even participated in a few ‘due diligence’ sessions. However, the impression I was left with, was they ended up being vehicles for MBAs and other consultants to sell services to investee companies at the expense of both investors and investee companies.

Today as the business environment shifts post-COVID and adapts to a changing interest rate environment we should probably re-evaluate our approach.

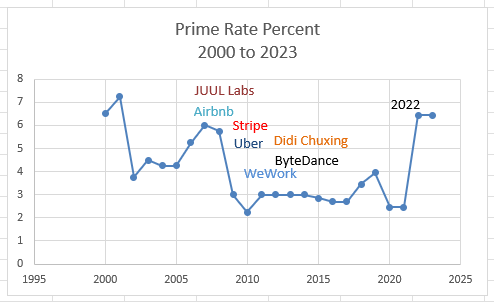

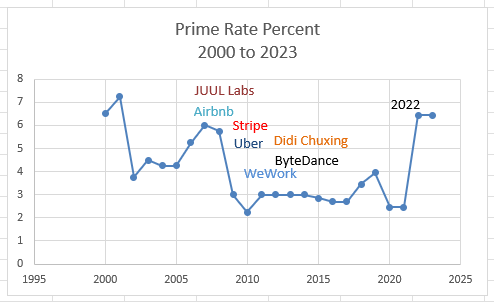

Top 7 Unicorns by Value 2017 (World Economic Forum)

Look at the correlation between the extended period of low interest rates post 2008, and the proliferation of unicorns. Alexandre Lazarow talks of camels instead of unicorns, and I think he’s right. We need to re-examine the Silicon Valley ethos. Venture capital financing based on cheap and plentiful money isn’t appropriate for any companies at the growth stage in today’s environment.

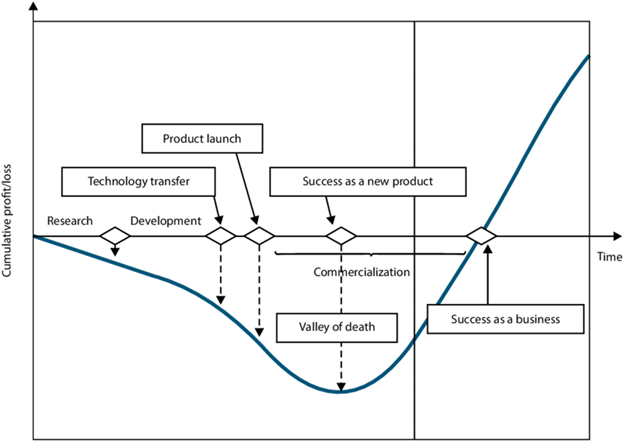

For start-ups trying to negotiate the ‘valley of death’, camels seem like a better choice than unicorns and are easier to find, unless you’re in Scotland.

The Valley of Death as Taught in Business School

But for seed stage and early-stage companies, the problem is even more acute. For them perhaps the more appropriate metaphor is not a camel but a sea turtle. Hatchlings need to quickly get to revenue, dodging predators. Sometimes predators have business degrees and like to call themselves ‘trusted business advisors’.