The Unicorn Kingdom

A SURVEY OF FIVE COUNTRIES (AND THEIR STARTUP ECOSYSTEMS)

(HUNTING FOR UNICORNS – PART 2)

Hunting for Unicorns – Youtube.com

According to CB INSIGHTS there are over 1,200 unicorns around the world.

A unicorn company, or unicorn startup, is a private company with a valuation over $1 billion. As of July 2023, there are over 1,200 unicorns around the world. Popular former unicorns include Airbnb, Facebook, and Google. Variants include a decacorn, valued at over $10 billion, and a hectocorn, valued at over $100 billion.

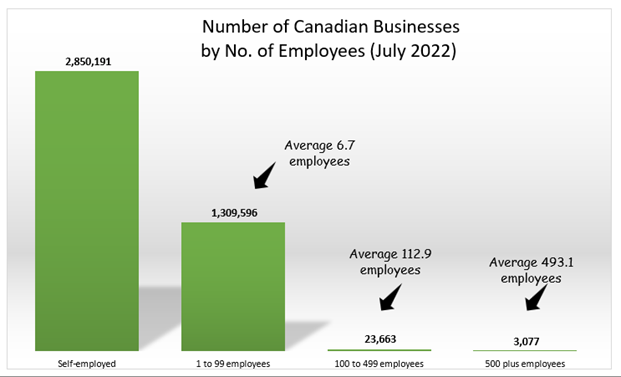

Economic development ministries worldwide are trying to reproduce the success of California’s Silicon Vally. In Canada – and almost everywhere else – that is clearly wishful thinking.

In my career as a tax accountant, I had the good fortune to work with one of the most highly-valued unicorns in Canada for about eight or nine years. That is a rarefied atmosphere for a sole practitioner on Canada’s West Coast. There have only been 21 such companies in Canada.

So, Who are the 1,200 Unicorns in our World? (And Who Invests in them?)

The private equity firms that invest in high-growth technology reside in 49 different countries. But – of the 1,225 unicorns worldwide – fully 1,099 (89.7%) are found in only 11 countries. Governments everywhere are trying to encourage ecosystems that support innovation and jobs in their countries.

I decided to look at the list and see if we can draw any conclusions from the results.

We start with the relative populations of each country. 11 countries had 10 or more unicorns in the list of 1,225. I did not evaluate results from:

- India

- China

- Israel

- France

- Germany

- Brazil

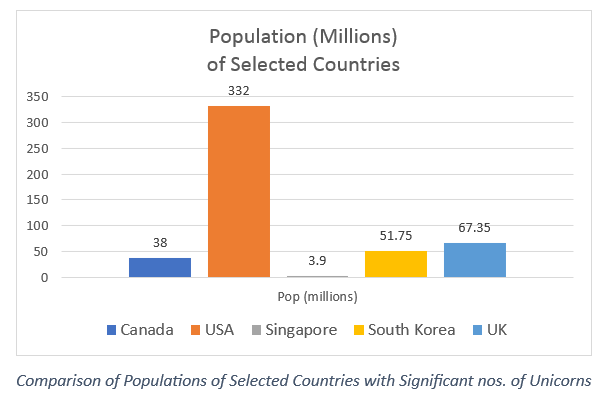

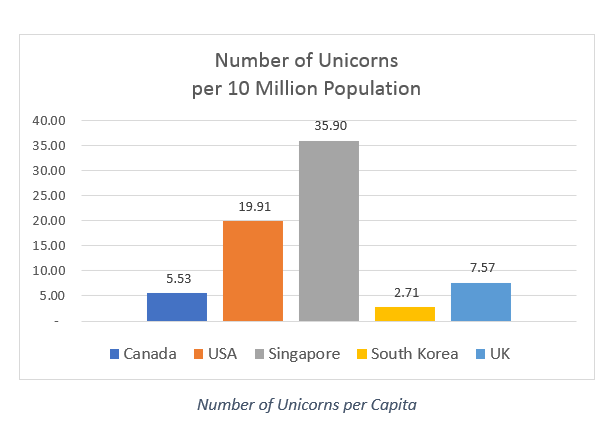

I selected the United States because they are our closest neighbours and they are obviously the epicentre of the world’s startup ecosystem. The UK appears to be ‘batting above its weight’ in Europe. In Asia, other than China and India, Singapore and South Korea are the most interesting from a Canadian perspective. Singapore is an outlier. With a population of about 4 million, it is tiny compared to anyone else on the list of 11 countries.

South Korea is – like Canada – a mid-sized country with a relatively strong economy[1].

So, what powers the startup ecosystems in these countries? Who provides private equity to make these companies grow? Where do unicorns live? Can we learn anything by reading the tea leaves?

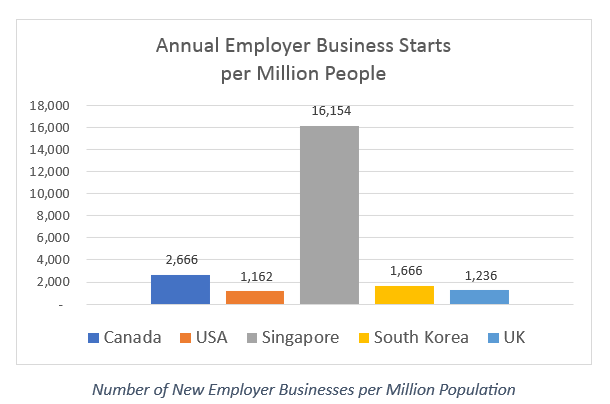

In this chart, we looked at the number of new incorporated businesses started each year[1], per one million of population. Interestingly, we might conclude that the US is perhaps less entrepreneurial than the other four countries. Canada looks quite entrepreneurial – except when compared to Singapore.

Despite somewhat lacklustre results when it comes to new business starts, the United States dominates in terms of the absolute number of unicorns (53.9%) worldwide. When it comes to ‘scaling’ businesses effectively, their success rate is pretty much ‘off the scale’ – except for Singapore, which dominates on a per capita basis.

I looked at Singapore because they are clearly an outlier – as we’ll see shortly – regarding the number of unicorns per capita.

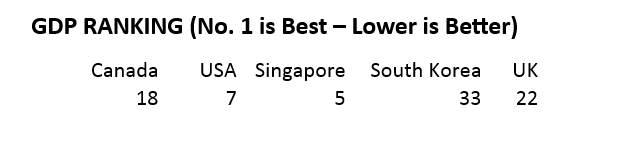

[1] Canada and South Korea are 18th and 33rd in terms of GDP per capita [1] Population data sourced from statistical agencies for each country – number of unicorns from CB INSIGHTS

ANALYSIS

If we can measure something as elusive as ‘entrepreneurship’, Canada appears to be more entrepreneurial than the US – and both South Korea and the UK. Singapore is clearly an outlier in every category. Singapore may warrant a much more stringent look – but I will forgo that temptation here.

We are relatively wealthy – our GDP per capita exceeded that of South Korea and the UK[1] – yet the UK produces more unicorns per capita.

What contributes to this disparity?

In the next article, we’ll look at the private equity firms that invest in high-growth companies in South Korea, the UK, and in Canada. We’ll attempt to evaluate the results and consider which factors might be at play in each of the ecosystems.

[1] As well as Germany and France (19th and 23rd) respectively