THE NEW CPA COMPILATION STANDARDS

CPA CANADA ROLLS OUT NEW STANDARDS FOR COMPILATIONS

In 2021, CPA Canada introduced a new standard for compilation engagements.

For accounting practitioners that work with small business clients that will mean increased work – and likely increased fees for their clients. Failing that the practitioners will absorb the cost and earn less as a result. So, to explain why practitioners require different kinds of documentation from their clients, the practitioners have been given ‘explainers’ from CPA Canada to distribute to managers and third parties that may receive financial information from borrowers, investee companies, or others that include a report from their accountant.

In the past compilation engagements were generally referred to as “Notice To Readers” since the report was entitled NOTICE TO READER and looked something like this:

NOTICE TO READER

On the basis of information provided by management, I have compiled the Balance Sheet of Small Business Inc. as at September 30, 2018 and the Statement of Income and Retained Earnings for the period then ended.

I have not performed an audit or a review engagement in respect of these financial statements and, accordingly, I express no assurance thereon.

Readers are cautioned that these statements may not be appropriate for their purposes.

Chartered Professional Accountant

Vancouver, BC December 19, 2018

The new standard replaces the NOTICE TO READER with a COMPILATION ENGAGEMENT REPORT. To the untrained eye, these reports may seem quite similar.

COMPILATION ENGAGEMENT REPORT

To Management of [Entity Name]

On the basis of information provided by management, I have compiled the balance sheet of [Entity Name] as at [date], the statement of income and retained earnings for the year then ended, and Note X, which describes the basis of accounting applied in the preparation of the compiled financial information [and, if applicable, other explanatory information] (“financial information”).

Management is responsible for the accompanying financial information, including the accuracy and completeness of the underlying information used to compile it and the selection of the basis of accounting.

We performed this engagement in accordance with Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements, which requires us to comply with relevant ethical requirements. Our responsibility is to assist management in the preparation of the financial information.

We did not perform an audit engagement or a review engagement, nor were we required to perform procedures to verify the accuracy or completeness of the information provided by management. Accordingly, we do not express an audit opinion or a review conclusion or provide any form of assurance on the financial information.

Readers are cautioned that the financial information may not be appropriate for their purposes.

[Date of the practitioner’s report] [Practitioner’s address]

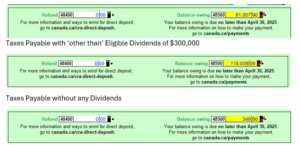

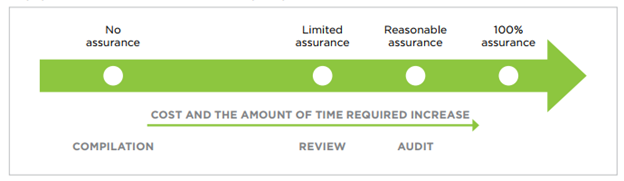

CPA Canada even provided a graphic tool to explain the amount of assurance provided by the 3 different kinds of engagement.

So, in both cases “on the basis of information provided by management, the accountant has compiled the financial information” described in the report.

Similarly, the accountant “expresses no assurance thereon” and notifies the reader that no audit or review was performed.

What are the differences?

- The practitioner should “read the compiled financial information and consider whether such compiled information appears misleading.

- Management must determine the basis of accounting to be applied.

- The practitioner must document their knowledge of the entity and the business of the entity within the file.

And how exactly do these requirements differ?

- Originally the requirement was that compiled information should appear “plausible”.

- In the case of most small businesses, management has little or no knowledge of the possible bases of accounting. The new standard generally will result in the practitioner “assisting management in selecting an appropriate basis”.

- The new standard requires a “Compilation engagement — Management acknowledgment of responsibilities” letter instead of a “Representation” letter.

How different are these requirements?

I would argue that there is very little substantial difference. Instead, it is mostly a difference in form rather than substance.

The accountant would have had to perform some sort of review to ensure that statements were plausible, before issuing them statements and attaching a Notice to Reader under the old standard.

How does that differ from what is required to ensure that statements don’t ‘appear misleading’ under the new standard?

How could anyone reach either conclusion without conducting a review?[1]

[1] Though clearly not a ‘review’ as meant by CPA Canada.

WHAT THE NEW COMPILATION REQUIREMENTS MEAN TO SMALL FIRMS

For most practitioners working with small businesses, the new standards are more of an annoyance than anything else. We are expected to rely on the client’s selection of an appropriate accounting basis. However, our clients don’t generally understand the various accounting standards.

So, to select the appropriate basis, we must first explain it to them. Then, we inevitably must explain that assurance standards are mostly irrelevant for tax purposes.

According to the CRA:

“The Income Tax Act (the “Act”) does not specify that financial statements must be prepared following any particular type of accounting principles or standards to determine profit. As the Supreme Court of Canada stated in Canderel Limited. v. The Queen 98 DTC 6100, the determination of profit is a question of law. Accounting standards are not law. In seeking to ascertain profit, the goal is to obtain an accurate picture of the taxpayer’s profit, for purposes of section 3 of the Act for the given year. The Supreme Court stated that a taxpayer is free to adopt any method which is not inconsistent with: (a) the provisions of the Act; (b) established case law principles; and (c) well-accepted business principles. It is our view that financial statements based on IFRS would be an acceptable starting point to determine income for tax purposes. In addition, where IFRS financial statements are used by a particular entity, it is our position that references to GAAP in the Act can be read as references to IFRS and all references to GAAP in any Agency publication can also be read as references to IFRS for those entities that report under IFRS.”

A great deal of the training for practitioners in public practice relates to the various assurance standards (ASPE – US GAAP – IFRS). These are mostly irrelevant for tax work. Instead, we are expected to determine profit. Presumably this might just as well start with “the ordinary meaning of words”[1].

In other words, even non-accountants have a pretty good understanding of what is generally meant by ‘profit’. After all, the balance sheet equation has been around since at least the 13th or 14th century.

[1] Also referred to as the ‘plain meaning rule’

Once a basis of accounting is ‘chosen by the business’ – or at least explained to them – practitioners must now explain that the business must not show the compilation engagement report to third parties who might rely upon it.

We might also explain that if our client shows our report in the future to a third party, who ‘might rely on the financial statements we prepare’ (but deny an opinion on), we may be required to seek legal advice on how to proceed.

Finally, we must document these discussions and considerations in our files.

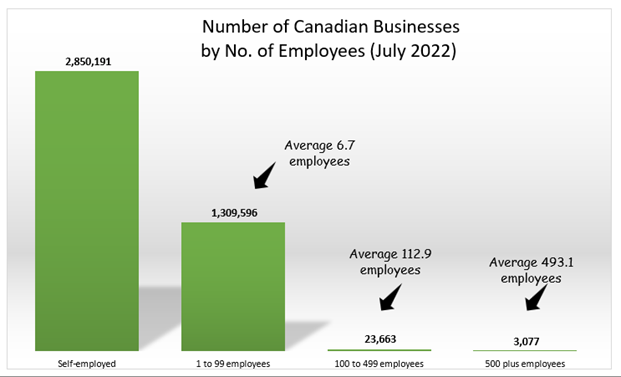

Presumably, all of this is now required because our professional monopoly relates to the provision of assurance that is declining in importance. Traditional audit work is becoming less important because entrepreneurial companies in Canada don’t go public anymore. According to an article in the Globe and Mail on October 17th of 2022 – “to date in 2022, only one operating company has joined the TSX, and it was really a secondary sale related to a spinoff.”[1]

Certainly, our professional regulatory bodies must do something. There are 13 of them in Canada and, by our estimates they bill about $780 million between them. As audits become less important, they need to make sure that they have something to do.

(POSTSCRIPT: According to an article dated June 22, 2023 in the Globe and Mail – “Ontario and Quebec accounting bodies to exit national CPA association”)

[1] Opinion: There’s been only one company IPO this year on the TSX, and that’s a problem – The Globe and Mail

ANOTHER MOTIVE FOR THE NEW STANDARD?

Until the new standard was published, there was a clear distinction between assurance and non-assurance standards. However, the new standard requires practitioners to quote from Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements – if only to say that we are not using any recognized standard (for example IFRS or ASPE). In so doing the lack of a standard has been elevated to the status of a standard.

Now, anyone issuing a COMPILATION ENGAGEMENT REPORT in BC may effectively be subject to regulation by CPA BC, since CSRS 4200 is, in fact, a standard.

While the CHARTERED PROFESSIONAL ACCOUNTANTS ACT in BC specifically allows non-members to act as accountants by virtue of section 46, section 47 would possibly subject non-members to sanction if they used the new report format prescribed by CSRS 4200.

Instead, it may be more appropriate for non-members to issue the previous version of the report – the NOTICE TO READER – rather than the new and ‘improved’ version. Alternatively, they might simply wish to attach a notice that the financial statements were PREPARED BY MANAGEMENT and avoid the issue altogether.

For my part I fail to see why pointing out that John Smith, CPA Inc on my letterhead – as opposed to John Smith, Chartered Professional Accountant – somehow poses a risk to the general public, as it apparently does under the new standard.

It is clear to me that the CRA does a much better job of protecting the public from inadequate tax practitioners than our “professional” file reviewers who are inevitably drawn from the audit side of the profession.