Are Colleges + Professional Bodies Guilty of Match Fixing?

According to a report released by Statistics Canada on November 30 of 2022:

“Recent immigrants made up nearly half of the growth in the share of Canadians with a bachelor’s degree or higher. However, some immigrants’ talents remain underutilized, as over one-quarter of all immigrants with foreign degrees were working in jobs that require, at most, a high school diploma. This is twice as high as the overqualification rate for Canadian-born or Canadian-educated degree holders.”

A 2017 study by the Harvard Business School and consulting firm Accenture found that the accounting occupation was the US occupation most at risk of what they termed “degree inflation”[1]. Their definition of ‘degree inflation’ looks much like what the Statistics Canada study described as the ‘overqualification rate’ for recent immigrants.

The Harvard study found that 2 occupational groups were most at risk of degree inflation:

- Supervisors of Office and Administrative Support Workers

- Bookkeeping, Accounting, and Auditing Clerks

The National Centre for Education Statistics in the US reveal that 18.9% of Bachelor’s degrees were awarded in Business,[1] (i.e. 391,375) in 2021. That was significantly more than in any other field. So, the most popular field of study is a prerequisite for the occupations most at risk of degree inflation. It seems that business colleges in the US, can at least teach us something about marketing. And these percentages align closely with the Canadian results we looked at a couple of years earlier.

[1] Digest of Education Statistics

Somehow, though, while bookkeeping, accounting, and auditing clerks don’t really require even a bachelor’s degree, according to the Harvard Business School study, CPAs in both the US and Canada need additional education after their degrees. In the US, most jurisdictions require a year’s experience and 30 more ‘credits’ after graduation. In Canada, CPAs have a 2-year Professional Education Program (PEP[1]) for graduates.

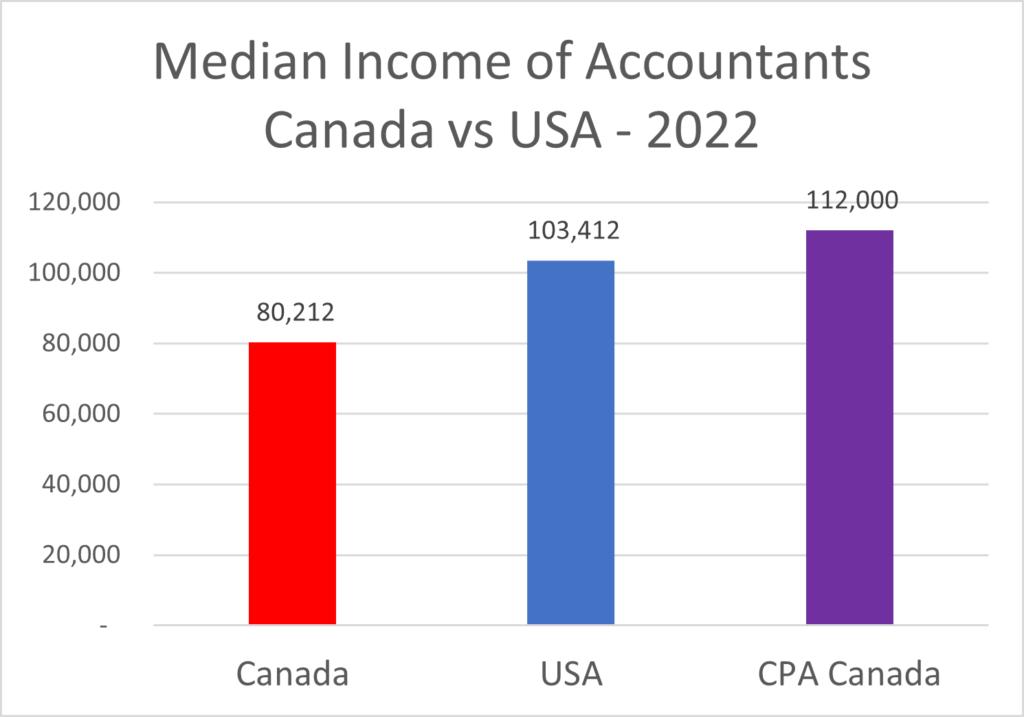

CPA Canada’s website exhorts prospective new members to earn their CPA designation and ‘become recognized leaders, exerting global influence’. They should be ashamed of themselves. As if that wasn’t bad enough, they inflate the expected median incomes of CPAs by about 40% (more in Ontario and BC).

[1] CPA Professional Education Program (CPA PEP)

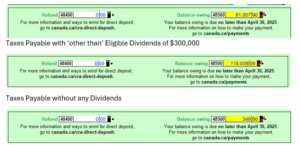

Canadian statistics in the chart come from the Canada Job Bank, while US statistics come from the US Bureau of Labor Statistics. The CPA Canada statistic comes from a study they commissioned – presumably to make the profession appear more attractive. The rationalization from CPA Canada is that the Canada Job Bank does not measure CPAs specifically. However, if you look at the qualifications for National Occupation Code 11100[1], both the numbers of workers and the educational requirements, seem to mesh exactly with CPA Canada’s requirements and membership. Have they convinced statisticians that Canada’s CPAs are the only accountants who work here?

[1] Financial Auditors and Accountants

The situation in the US is a little different. In the US, CPA members account for only 44% of accountants, according to the US Bureau of Labor Statistics. Consequently, it’s hard to know whether a CPA designation in the US comes with a significant premium in terms of expected median incomes since that isn’t measured.

While the accounting profession emphasizes the importance of understanding ethics as a foundational competency, CPA Canada’s complicity in inflating expected median incomes of its members as a marketing ploy, suggests that for accounting regulators, self-interest is more important than ethics.

For a profession that has championed corporate finance techniques such as net present value analysis, this isn’t a very good look. Universities and professional bodies front-end load extensive educational costs on students before they have a chance to earn anything. If students conducted net present value analysis on the investment in a CPA designation, business degrees might not be as popular. This is very short-term thinking on the part of the profession.

Instead of forcing recruits to invest in ever more education, playing on the ambitions of young people to “become recognized leaders, exerting global influence”, perhaps they should create a larger role for accounting technicians. Recruits could easily pick up what’s necessary to be capable “bookkeeping, accounting, and auditing clerks” with a few short technical courses and strategically placed on-the-job training.

“let’s not forget that it is just not possible to give everyone their dream job. If our career aspirations surpass the available opportunities, and our self-perceived talents exceed our actual talents, we are surely destined to be miserable at work…”[1]

…and to blame affirmative action, white males, immigrants, or gender equity programs for our lack of success…

[1] Quote from 6 Reasons Higher Education Needs to be Disrupted Harvard Business Review