Audit and management consulting work are largely irrelevant for the smaller 99% of firms that dominate the sector. Auditing has been declining in importance since the US public markets started shrinking since their heyday in the mid to late 1990s.

Today private equity is the most common way for early-stage companies to scale their operations. In Canada we do have about 4 times as many public companies in the much-loved ‘mid-sized’ company category[1]. In our view it is the audit firms and securities lawyers who are the primary beneficiaries[2], and not the small businesses that list on our Canadian stock exchanges.

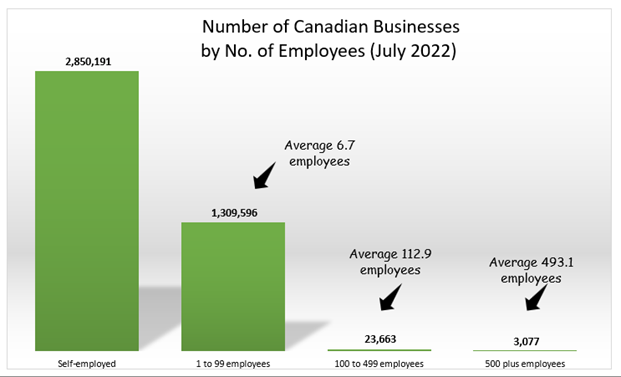

[1] Our analysis of CRUNCHBASE.COM data shows 9.42% of our 23,663 businesses with 100 and 499 employees, are publicly-traded. This compares with 2.4% of the 164,134 mid-size companies in the US.

[2] See this article on CHAR TECHNOLOGIES in the MAINSTREETJOURNAL.CA

Management Consulting

According to a Wikipedia article on the Phoenix pay system, the Harper government hired IBM in June 2011 to provide the software for the new payroll system, using PeopleSoft software. The project was initiated in 2010 as part of the Transformation of Pay Administration Initiative, intended to replace Canada’s 40-year old system with a new, cost-saving “automated, off-the-shelf commercial system.”

However, the project faced many challenges and delays, and IBM advised both the Harper and Trudeau governments to postpone the launch of the system, as it was not ready to go live. The bureaucrats rejected IBM’s advice, citing the need to move the payroll specialists to a centralized location in Miramichi, N.B. The system was launched in April 2016, and since then, it has caused pay problems to thousands of federal employees, costing the government billions of dollars to fix.

The current status of the system is that it is still not fully stabilized, and there are about 200,000 unresolved transactions as of April 2023. The government has spent more than $2.4 billion as of April 2022 to fix the system and compensate the affected employees. A replacement system is in the works, but it is not expected to be ready until 2025.

In 2010 through 2012, I worked as a senior manager at Myers Norris Penny in Vancouver (one of Canada’s 10 largest CPA firms).

Although I was a tax specialist in the scientific research and experimental development tax credit program, I had my office on the same floor as the management consulting group.

From my perspective, what the management consulting group was about was taking the Rolodex of the senior partner of the management consulting group, to find contacts within British Columbia’s provincial government of the day.

Since we were in Vancouver, our primary market was the BC government.

The partner sold work and then recruited 20 or 30-something college graduates with little or no experience – but significant education. They were MBAs, certified management consultants, or had undergraduate business degrees.

From my perspective, I fail to see how anyone can certify someone else as a management consultant.

I am reminded of legendary US rear admiral Grace Hopper (1906-1992), who was the first to devise the theory of machine-independent programming languages. She developed the FLOW-MATIC programming language which was later extended by others to create COBOL, an early high-level programming language still in use today.

According to Hopper:

“You manage things, you lead people. We’ve gone overboard on management and forgot about leadership. Maybe it’s time we ran the MBAs out of Washington.”

In my view, the management consulting group had no experience and no real skills in management, These folks certainly had learned how to write very persuasively. For them, more syllables were always better. Usage became ‘utilization’ for instance, which certainly sounds more effluent erudite.

I couldn’t help but think that the primary role of the long reports they wrote was to put in the bureaucrat’s file to protect decisions made by politicians. It gave them the option to point to an expert opinion, in case the policies they implemented failed.

That may not be a very charitable view, but it seems to me that today’s management consultants figured out how to evolve from buying influence to selling it.