These days the conventional wisdom is that you can take someone with average intelligence and buy them a QuickBooks license. Then, get them to watch a couple of YouTube videos and do the company’s books.

Certainly the folks at QuickBooks (or XERO) would like you to believe that anyone can do their own books – with the right software. The story goes that you just link the company’s bank and credit card accounts to your accounting software of choice and process the transactions through something like an artificial intelligence engine that you tweak yourself.

What could be simpler?

This aligns well with another myth that most college graduates learn from their introductory accounting instructors at university.

The mantra usually goes something like this:

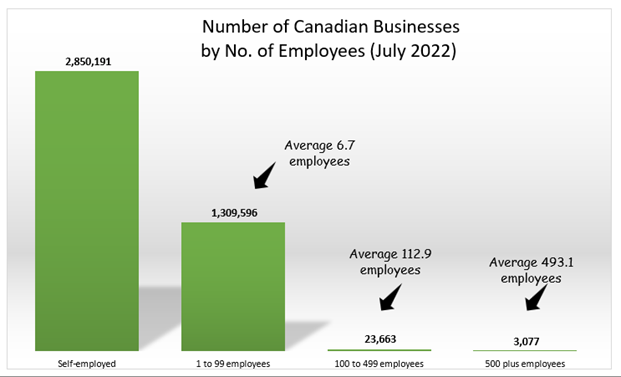

“Owner-managers of small businesses need timely and accurate financial reporting, so they can use the information to manage their businesses.” This perspective wouldn’t be too far off if you accepted Statistics Canada’s definition of a small business as a company with fewer than 100 employees and focused on the top 2% of businesses with 50 or more employees.

Please Don’t Make Them Do the Books! –

WATCH FULL VIDEO:

Related Content:

Codat_Global_Accounting_Guide_2021.pdf

The demand for accounting software packages has gained momentum in recent years. The growth has been aided in regions such as the UK by the introduction of Government initiatives such as Making Tax Digital. In addition, the already evident shift in demand from desktop-based packages to cloud-based services has been propelled further forward as small businesses look to manage their finances and access support remotely. It has also inflated the addressable market for accounting software providers.

Read More: Click Here