Just this morning I was on a video conference with a chartered accountant from India and our shared client and his local accounting technician. One of the issues was the complexity of Canada’s goods and services tax regime. It wasn’t supposed to be that way. I was around when the conservative government of the day introduced the GST in 1991, as a replacement for the much older federal sales tax that was charged by manufacturers to their customers.

It made sense to remove the federal sales tax which was an impediment to our goods-producing sector which has been shrinking as a percentage of our gross domestic product for decades. The way it was described, it should have been simple. You could simply have calculated the GST paid as a percentage of the total purchase price and calculated the GST charged as a percentage of the sales price. Then paid – or received back – the difference. You wouldn’t even need the receipt to calculate the tax. But it never worked like that.

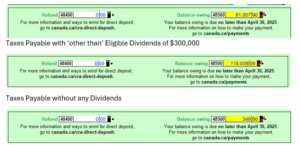

None of the provincial or territorial governments could leave well enough alone. In fact, only 5 of Canada’s 13 jurisdictions are ‘participating provinces’. These provinces replaced their existing provincial sales taxes with ‘Harmonized Sales Tax’ – each at their own rate. The remaining 8 jurisdictions have kept their pre-existing provincial (or territorial) sales taxes. In a small country like Canada with a population of just over 40 million, we now have 13 different combinations of provincial and territorial sales tax in addition to the GST – which is applied at different rates in different provinces. Predictably, the Province of Quebec – which has always considered itself to be special – has replaced the GST with the QST, further complicating compliance when companies sell to customers in different parts of the country.

Related Content:

The Paperwork Study

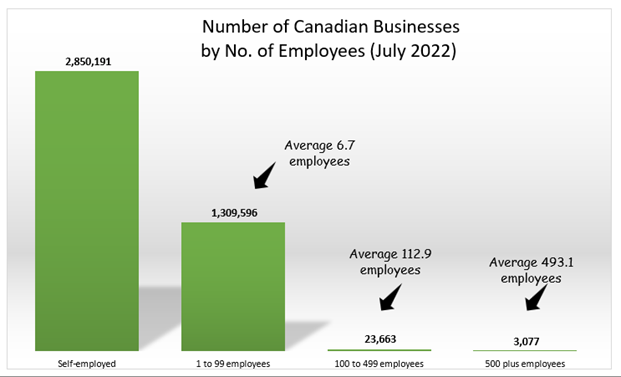

In 2005, the Canadian Government of the day launched a comprehensive study of the tax and regulatory burden faced by Canadian businesses. This was likely in response to the Canadian Federation of Independent Business’s study which found that 65% of its members “considered government regulations and the associated paperwork burden to be one of their members’ greatest concerns, second only to the tax burden itself. Between the 2005 base year and 2020, no less than four analyses were published. The first two were compiled by Statistics Canada in conjunction with Industry Canada. The last two were published by the Canadian Federation of Independent Business itself, with two different collaborators. In this first of two videos, we’ll look at THE PAPERWORK STUDY published by STATISTICS CANADA in 2010.

Watch Video: Click Here

CFIB Studies

In 2013 the Canadian Federation of Independent Business published a study in collaboration with KPMG, Canada’s second largest accounting firm. They compared annual regulatory costs in Canada with those in the US. The end result was that the cost per employee was 1,858 dollars higher per employee.

In 2013, the US and Canadian dollars were assumed to be at parity. Fast forward 8 years to 2020, and the US dollar had increased to an average of 1.3415 times the value of the Canadian dollar.

Watch Video: Click Here