BC’s Venture Capital Tax Credits – Do They Make Sense?

(Hunting for Unicorns – Part 1)

Government Incubators – Youtube.com

About ten years ago, I invested in a VCC in the Province of British Columbia. ‘VCC’ is the acronym for a VENTURE CAPITAL CORPORATION as defined by my province’s SMALL BUSINESS VENTURE CAPITAL ACT.

BC’s Venture Capital Program is one of many provincial government programs delivered by the Ministry of Jobs, Economic Development and Innovation, which is designed to spur economic development in the province.

VENTURE CAPITAL CREDITS IN OTHER PROVINCES

In this article, I will review my own experience as an investor, and as a tax professional dealing with companies in the tech sector, to try and get a sense of the effectiveness of BC’s program.

First of all, a little bit about the program.

(Author’s Note: this article deals primarily with the VCC model designed for teams of angel investors. The program also supports investment in Eligible Business Corporations by individual investors (or corporations). The second model is, in my view the better option for most investors, companies, and taxpayers.)

Yesterday I went to the BC Government’s website and copied this description of the program…

To begin with, the description of the program on the BC Government website was incorrect.

“The small business venture capital tax credit is for corporations that invest in shares of a registered venture capital corporation or eligible business corporation.

The small business venture capital tax credit encourages investors to make equity capital investments in B.C. small businesses, in order to give small businesses access to early-stage venture capital to help them develop and grow.”

The Small Business Venture Capital Act is truthfully designed to encourage “investors to make equity capital investments in B.C. small businesses, in order to give small businesses access to early-stage venture capital to help them develop and grow.”

However, it is available for both corporations AND individual investors in eligible BC-based businesses.

“Corporations may claim a tax credit in a tax year equal to the lesser of:

• The amount of the tax credit certificate issued by the administrator of the venture capital corporation or eligible business corporation programs, or

• Provincial income tax otherwise payable

Budget 2019 enhanced the venture capital tax credit program under the Small Business Venture Capital Act.

The small business venture capital tax credit may be applied only to provincial income taxes payable. If you cannot apply your entire tax credit amount to B.C. taxes payable in the year, the excess may be carried forward up to four years.”

Once again, the description on the website is inaccurate.

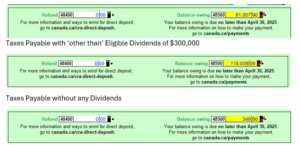

‘Individual investors’ can also qualify for refundable VCC credits in the amount of 30% of eligible investments. They are entitled to a refund of the entire amount of the tax credit according to Subsections 21(2) and (3) of BC’s INCOME TAX ACT . Venture Capital Corporations (“VCCs”), which receive an allocation of tax credits under the act, reallocate those to their investors, who generally are individuals.

The incentive is quite rich, allowing for individual investors to receive tax refunds in cash, amounting to 30% of their investment. Given the level of risk, this is probably not as attractive as it might seem to the uninitiated. Steve Blank2, noted expert behind the “Lean Startup” methodology has described a startup’s chance of success as “infinitesimally low”.

Two Investment Models

The BC program offers a choice of two different investment models:

-

1. EBC MODEL – Eligible Business Corporations are individual companies located in BC that meet eligibility requirements

-

2. VCC MODEL – Venture Capital Corporations are sole purpose investment corporations that assemble mostly individual shareholders to invest in the same kind of companies

Identifying promising growth businesses in the technology sector is very challenging. Most startups will fail, since many were never businesses in the first place. Steve Blank would probably describe startups at a very early stage as ‘science experiments searching for a minimum viable product’ to build a business model around.

Successful investments generally need internal rates of return in the neighbourhood of 60%, to make the math work and compensate for failed investments.

So, a tax incentive of 30% may not be excessive, depending on the policy goals of the program.

Ideally, the program would help build successful technology businesses, and encourage the development of a home-grown private equity sector. Both goals are commendable. It is also desirable to match would-be entrepreneurs with skilled investors and managers.

In this series of articles, I will look at successful startups – lovingly referred to as unicorns3 – that originated in BC over the last 12 years or so. I will start with my experience with the VCC model as an investor.

My Experience with BC’s VCC Program

My goal in purchasing the shares was to get to know early-stage technology companies, which were a target market for my firm. Apparently, the CFO of the Venture Capital Corporation I invested in had the same idea. He continues to operate a consulting firm, providing management consulting services – almost certainly to the same companies the VCC invests in.

[1] Individuals can get a full refund of the VCC credit up to a maximum of $120,000 (Section 2 of the BC Income Tax Act)

[1] To a maximum of $120,000 [1] Effective for the 2022 to 2024 calendar years, Budget 2022 proposes to increase the annual maximum

Looked at another way, he seemed to be using the investors’ money in the VCC as bait to land management consulting contracts with investee companies. I started off by providing due diligence services to our venture capital corporation. Ostensibly they wanted help evaluating potential investee companies.

I took my role seriously and requested information from a target company, as to why another investor who was involved in the same technology space had backed away. The CFO of the VCC became annoyed with me, letting me know that he knew the company well and that my concerns were superfluous.

So why were investors encouraged to perform due diligence, when the CFO had already made the investment decisions?

In English, that meant to me, that the CFO had already plucked a lucrative consulting contract from the investee company and that our VCC had to deliver an investment to solidify his contract. My job was to validate the investment. Of course, I may have misread the situation.

After that experience, I stopped wasting my time with the VCC.

Over the years, under the CFO’s guidance, the VCC changed the capital structure of the company adding about 21 classes of shares – without seeking shareholder approval – seemingly in contravention of the BC Corporatiions Act. Then the CFO had the corporate records moved to the basement of his home in a posh suburb of Vancouver and tried to refuse access to my lawyer to view the corporate records. This is also a contravention of the BC Corporations Act. My lawyer eventually convinced him to provide her with access.

Today there are more than 20 classes of shares – each with different entitlements to specific investee companies. My lawyer informs me that this is also a contravention of corporate law.

The litany of issues and violations continues. It even appears that the trust that holds my shares in an RRSP is a little too close to the CFO. He provided the trust company with a valuation of my shares of the company. The valuation of each class of shares is identical – even though each class derives its value from different investments. This is a logical impossibility. The different values of the various stock portfolios underlying the 21 different classes of shares would have to be identical in relation to the subscriptions for each class.

Despite this, my trust company advised me to engage a chartered business valuator if I wish to dispute the valuation provided by the CFO. If it were even possible to determine a value, the cost to do so would certainly be prohibitive. It might even exceed the value of the entire company, not merely that of my own small holding.

My point is not that I have lost an investment that – after my tax credit and RRSP deduction – cost me $3,000.

The point is that the MINISTRY OF JOBS, ECONOMIC DEVELOPMENT AND COMPETITIVENESS that administers the VCC program may be wasting taxpayers’ money4. The incentives under the program amount to between thirty and forty million per year. Since the inception of the program that probably totals close to half a billion dollars.

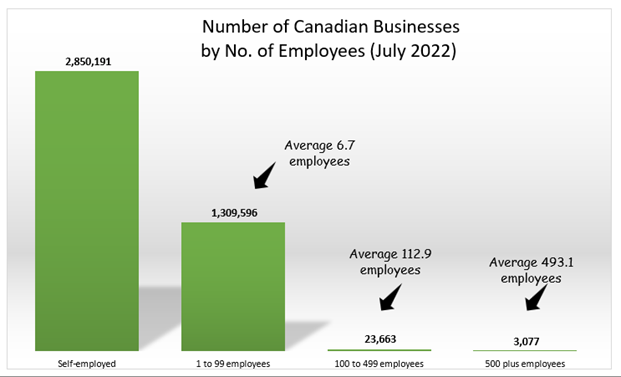

During that time, BC has produced 5 unicorns with an estimated valuation of around $15 billion. If the VCC program has contributed to that result, it may well have been a good investment by the government.

To what extent has the VCC program been responsible to those successes and, have we been successful in developing a local private equity sector?

In the next two articles, I look at a list compiled by CB INSIGHTS – a private equity researcher – of unicorns worldwide.