ACCOUNTING SYSTEMS FOR SMALL BUSINESS IN CANADA

How Enhancements to Information Technology Have Impacted Accounting Systems for Small Business in Canada

There is no doubt that improvements in information technologies have brought with them a great deal of change to the way we live our lives. Think smartphones, NetFlix™, Spotify™, and remote work.

As a public accountant serving primarily small businesses with fewer than 20 employees, I see changes in the way accounting is done, but these changes haven’t really reduced the cost of information or improved the accuracy of accounting data over the last 40 years or so.

Certainly, the opportunities for both reductions in cost and improvements in accuracy exist. But somehow, stubbornly, these inefficiencies remain.

The Disappearance of ‘Journals’ in Contemporary Accounting Software

The fundamental accounting algorithm relies on the fact that transactions have at least 2 parts:

- The ‘money part’ – usually a bank, quasi-bank, or credit card account

- The ‘other part(s)’ – typically sales, expenses – but also investments, other assets, liabilities, or consumption tax components

Traditional, manual systems forced the bookkeeper to record the entire transaction, with all of the component parts in a single “source” journal. This allowed the auditor or reviewer to easily reconstruct the entirety of the transaction, by simply referring to the journal.

By contrast, contemporary accounting software separates each transaction into its component parts and ‘posts’ the data directly to the general ledger. Presumably, the software engineers that designed accounting software, felt that it was unimportant to maintain the integrity of all elements of the transaction. Perhaps they thought that, since the ‘money part’ is imported directly from the online records of a third party – i.e. the bank or credit card company – the posting of the ‘other part’ to the general ledger creates a kind of virtual journal.

However, the software engineers who build accounting systems don’t use them. So, they are never faced with the need to understand – and correct – the categorization errors made by the bookkeeper.

When categorization errors occur – and they inevitably do – the accountant or reviewer may need to scour the entire general ledger to find and correct the error.

The Black Box Effect

If bookkeepers were all adequately trained, categorization errors would be inadvertent. While still a nuisance for the reviewer, there would be fewer errors to deal with. However, software publishers try to create the impression that their software is so well designed that everything is automatic. Transactions are imported directly from the bank. As a result, the bank is reconciled automatically.

What’s more, since the categorization of the ‘other parts’ can soon – after a little training – be handled automatically by the software, the allocations are inevitably accurate. Hence accurate financial statements are available at the push of a button.

In the manual accounting systems that the software was designed to replace, the bookkeeper reconciled the bank balance in the general ledger, to the bank statement. After recording transactions in ‘special purpose journals’, totals were then posted to the general ledger. The bookkeeper then ran a ‘post-closing’ trial balance to ensure that the ledger was in balance.

Certainly, if all of the bank transactions were imported properly from the bank, the bank account would reconcile, AND the general ledger would automatically be in balance.

Over the years I have occasionally seen an error in the detailed trial balance of a computerized system. I attributed this to a computer crash, while transactions were being posted to the ledger. Presumably, the ‘indexes’ in the file didn’t update correctly. However, these are rare events. Most of us have too much confidence in the accuracy of computer-based accounting systems. We tend to believe that the computer is a kind of magic black box, and that it can’t be wrong. Certainly, the general ledger balances, and everything looks very neat.

None of us is immune from the ‘black box effect’ – as we’ll see shortly.

3 Case Studies

One

A Canadian MBA (2018) with more than 4 years of experience as a financial analyst working for one of Canada’s largest cities.

A few days ago, just prior to the filing deadline for T4s and T5s, I received a file from the daughter of a former client. According to her, “the bookkeeping had all been done in Quickbooks™ Online”.

I wanted to believe that it was accurate, to give me time for some tax planning before the deadline.

The person doing the accounting was a friend of hers.

Her friend had an MBA in Finance from a reputable Canadian University and more than four years of experience as a financial analyst – and later as a ‘senior’ financial analyst – with one of Canada’s largest municipal governments.

As we got ready to file, it turned out that the $86 thousand in the bank account on the balance sheet, didn’t exist. I found this out when, eventually I got a copy of the bank statement.

After I found that out, we threw out the QBO™ data, used a spreadsheet to summarize the bank transactions and posted them to a working trial balance application we had built ourselves.

Two

A Team of 15 CPAs, Chartered Accountants, and bookkeepers in Pakistan

“Welcome to Strategis Bookkeeping Services. We are an accounting and bookkeeping firm that provides online bookkeeping, accounting, management reports, financial statements, business activity statements, end-of-financial year (EOFY) adjustments, and tax preparation services. The finest CPAs and chartered accountants in our team assist our clients in making better business strategies, budget planning, forecasts, and cost control procedures. Our cloud accounting certified team of professional bookkeepers is available 24/7 to help you update, catch up, clean up, and reconciliation of your business’s day-to-day operations. Our bookkeeping team is certified in tools like QuickBooks, Xero, MYOB, WAVE ACCOUNTING, SAGE-50, and spreadsheets.”

A few months ago, a software developer with a subsidiary in India, hired a Pakistani firm to do the bookkeeping for the Canadian parent company.

The Indian subsidiary had been audited by a firm of Chartered Accountants in India. My job was to file the Canadian tax return of the parent company. With all their professional certifications (CPAs and CAs) and experience with online accounting software, I thought I should be able to rely on the bookkeeping file prepared by the Pakistani firm.

However, in addition to reconciling the bank to a bank statement, I tried to reconcile the parent’s intercompany account with that of their subsidiary in India. Since the receivable of one company was the liability of the other, and the revenue of one was the consulting expense of the other, these accounts should match.

No such luck.

The ‘professional’ bookkeeping firm simply posted all the payments from the parent into the intercompany account. Not only did the intercompany account not balance, but the income was overstated by $90 thousand.

What’s more, the Pakistani firm had no understanding of the workings of Canada’s goods and services tax. So almost all the transactions had to be re-examined for possible GST implications.

THREE

A CPA (2017) in the Philippines working remotely with a San Francisco-based financial services startup .

About a month ago, a software developer in the US with a small subsidiary in Canada, hired a CPA from the Philippines to do the bookkeeping for the Canadian subsidiary.

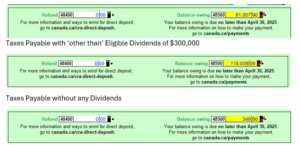

For some reason, he didn’t think it was necessary to reconcile the bank accounts to the bank statements provided by the company. As a result, he missed recording several transactions and relied on the ‘reconciliation’ function within QBO™. (i.e the Black Box Effect)

Many of the transactions found their way into the Canadian bank account from the corporation’s US-dollar bank account. Instead of using the actual exchange rate used[1] to determine the Canadian-dollar equivalent, he relied on a table of rates published by the Bank of Canada. This resulted in a $38 thousand dollar discrepancy in the transfer clearing account.

[1] The actual exchange rates used were shown on the bank statements provided

Afterthoughts

Almost all the data in each case was available online from each of the companies’ bank (or credit card) accounts. In each case, the owner of the company or their executive assistant – if they had one – could easily download the data directly from the bank into an Excel-compatible file. This could have allowed us to bypass QBO completely.

Clearly, none of the business owners understood the data generated by their online accounting software. If they had, they would have known that the financials in QBO™ were completely inaccurate. While Canada’s online accounting software is useful when it comes to invoicing and collecting fees from clients, it could do a better job of preserving all the elements of transactions in what we used to call “special purpose journals.”

“special purpose journal” according to CHAT GPT:

In bookkeeping terminology, a “special purpose journal” refers to a type of accounting journal that is used for recording specific types of transactions. Unlike general journals, which record a wide range of transactions, special purpose journals are designed to efficiently record repetitive transactions of a similar nature.

For example, common types of special purpose journals include:

- Sales Journal: Used to record all credit sales transactions.

- Purchases Journal: Used to record all credit purchases of inventory or supplies.

- Cash Receipts Journal: Used to record all cash received from various sources.

- Cash Disbursements Journal: Used to record all cash payments made by the company.

By using special purpose journals, businesses can streamline their accounting processes, improve efficiency, and organize transactions more effectively. This allows for easier analysis and retrieval of specific types of transactions when needed.

Not only is most accounting software not really a good fit for the self-employed or micro-businesses, but the people doing the work were themselves inadequately trained. Between them, their services had little or no value.

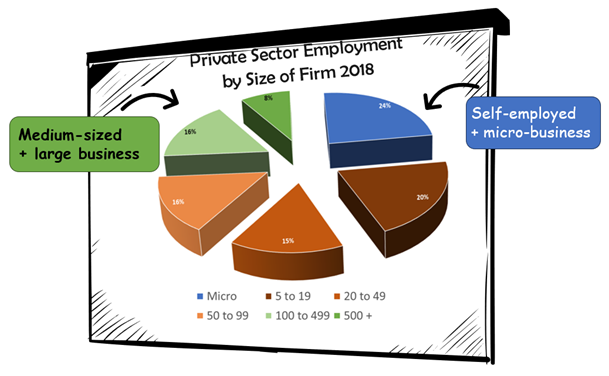

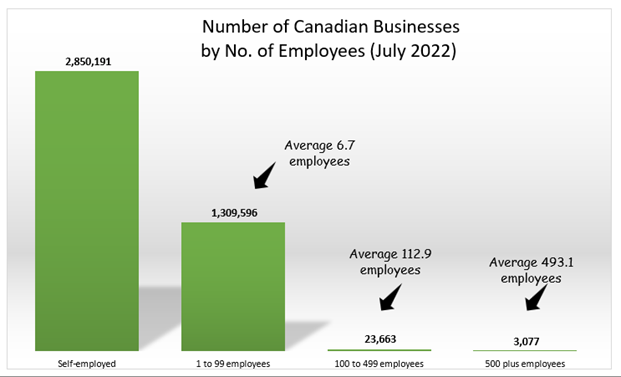

About 24% of Canadian private sector workers work for companies with 4 or fewer staff. The businesses they work for include more than 80% of all businesses in Canada. While they are targeted as customers by both accounting software publishers and our small accounting service businesses, they could be much better served.

Instead of training so many CPAs, MBAs and financial analysts, we need many more skilled accounting technicians, who can do a better job for this poorly served sector of our economy.