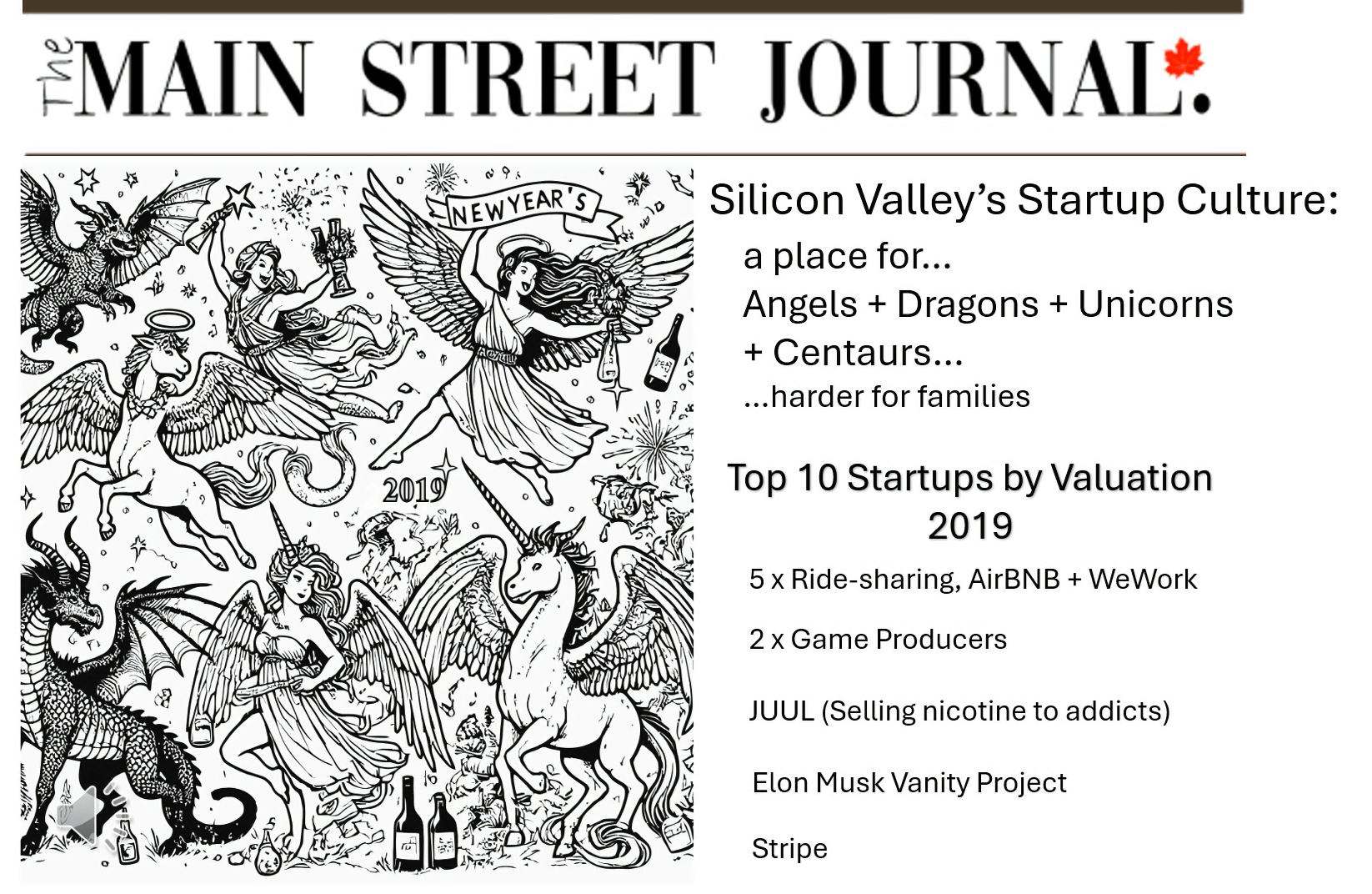

What are the chances of a successful exit for angel investors in a startup?

Angel investing is a high-risk, high-reward game. The chances of a successful exit for angel investors can vary widely depending on several factors, including the startup’s industry, market conditions, and the effectiveness of the startup’s management team.

On average, angel investors can expect to see a successful exit in about 20-30% of their investments. This means that roughly 1 in 4 to 1 in 5 investments might result in a profitable exit, such as through an acquisition or an initial public offering (IPO). However, it’s important to note that these statistics can vary significantly, and many angel investors diversify their portfolios to spread the risk.

Successful exits typically occur within 6 to 9 years, but this timeline can be longer depending on the startup’s growth and market conditions. The most common exit strategies for angel investors include acquisitions, where a larger company buys the startup, and IPOs, where the startup goes public.

Risks of Founding a Startup

WATCH FULL VIDEO: